经济下行,为什么华尔街日报还认为福耀前景可期?

在经历几年海外布局之后,福耀集团的海外战略已逐渐收获成果。6月初,从美国伊利诺伊芒山工厂传来喜讯,两条浮法玻璃生产线均完成升级改造,进入正式生产阶段,年产量可达28万吨。俄亥俄州汽车玻璃生产基地已完成200万套产能,当地客户的产品已实现量产。

同时,高附加值产品的研发让福耀不断拓展“玻璃的边界”,获得客户青睐。

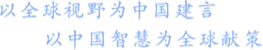

华尔街日报专栏记者Abheek Bhattacharya在6月15日发表文章《Glass Ceiling Investors Can Break(汽车玻璃前景可期)》,他认为市场畅销车型的转变为福耀玻璃提供了持续增长的机会。以下为报道摘录。

汽车玻璃前景可期

作者:Abheek Bhattacharya

原载:华尔街日报

汽车销售低迷,这并没有影响到世界唯一一家纯汽车玻璃供应商近期的发展前景。

福耀玻璃,已于香港及上海上市,市值达54亿美金,拥有至少40个提供挡风玻璃、天窗及车窗等汽车玻璃的生产基地。公司是截至目前为止中国最大,及全球三大生产商之一。

这些荣耀在去年并没有发挥重要作用。由于去年政府减税导致中国汽车市场不稳定,福耀股价仅略高于其在香港上市时的股价。然而公司正在通过提高海外销售额来降低其在中国面临的风险。公司成功依托国内关系,使海外销售收入占总收入比重达到三分之一。例如,公司同时为中国本田和美国本田供应汽车玻璃产品。

今年,公司将增加在美国俄亥俄州的销售,与此同时,俄罗斯工厂的销售扩展也会为欧洲市场服务。根据德意志银行的分析,这将使公司今年及明年分别提产16%及9%。

诚然,今年美国轻型汽车销量削弱,但大型车辆在美国(油价下跌)及中国(安全意识增加)均有增长。美国小型货车销量自去年五月至今年一月增长9%,而中国SUV出货量亦增长45%。

这对玻璃供应商无疑是一个宝藏,而原因不仅在于SUV需要更大批量的玻璃。尽管汽车制造商因自身利润缩减而要求降价,但通过销售SUV的全景天窗玻璃等产品,福耀仍得以拉高其平均产品售价。

与大多山寨中国制造商不一样,福耀将4.4%收入投资在科研与开发,较日本竞争对手旭硝子所投入的3%多。

福耀2017年预测市盈率为10.6,对比其他九家全球汽车供应商及玻璃制造商的平均市盈率13.8,股息收益率为5%。根据标准普尔全球市场情报指出,待福耀完成目前扩张计划后,公司资本开资将降低,现金流将增加两倍。

A rough patch for car sales is supposed to be rough for niche firms that supply car parts. But at the world’s only listed, pure-play supplier of auto glass, a combination of a buoyant SUV market and its own expansion could leave its near future smooth and gleaming.

Fuyao Glass Industry, listed in Hong Kong and Shanghai with a market capitalization of $5.4 billion, supplies windshields, sunroofs and windows to at least 40 manufacturers. It is by far the largest producer of automotive glass in China. It also has broken into this concentrated market to become one of the top three such firms in the world.

These accolades haven’t mattered in the past year when China’s car market has looked unstably propped by government tax breaks, causing Fuyao’s shares to languish not far above its Hong Kong IPO price last year. Yet the company is reducing its exposure to China by increasing sales abroad. It already makes a third of its revenue overseas, having successfully leveraged relationships at home. For instance it supplies Honda in China and the U.S.

This year, the company will ramp up sales from its Ohio factory. A similar expansion in Russia will serve Europe. That will boost overall volumes by 16% this year and 9% next, according to Deutsche Bank.

Granted, the U.S. light-vehicle market has weakened this year, too. But bigger vehicles still are growing both there, thanks to cheap gasoline, and in China, thanks to consumer interest in safety and status. U.S. light-truck sales are up 9% between January and May from the year before, while Chinese SUV shipments rose 45%.

That is a bonanza for a glass supplier, and not just because SUVs require larger quantities of glass. Despite price cuts that car makers demanded as their own margins shrank, Fuyao has managed to increase its average selling price by selling products such as the panoramic sunroofs that adorn SUVs.

And unlike many copycat Chinese manufacturers, Fuyao is investing in improvement. It spends 4.4% of revenue on research and development, compared with about 3% at Japanese rival Asahi Glass.

Fuyao trades at 10.6 times 2017 earnings, compared with 13.8 times for a basket of nine global auto suppliers and glassmakers. With a 5% dividend yield, it pays to wait for those earnings. After its current expansion plans are complete, capital expenditures should fall and free-cash flow should triple, according to S&P Global Market Intelligence consensus estimates.

文章选自福耀集团,2016年6月21日