- 当前位置:

- 首页>

- 活动>

- ������������

������������

CCG持续关注国际关系议题,推动中国与全球化的发展,积极开展国际交流,充分发挥智库“二轨外交”作用,在巴黎和平论坛、达沃斯世界经济论坛、慕尼黑安全会议等重要国际政策与意见交流平台上组织分论坛、边会、圆桌会议、晚宴等活动,促进国际政商学界对话,凝聚共识;CCG积极与各国政界、智库界、工商界开展“二轨外交”活动,每年常态化赴多国调研与交流,促进中外关系攸关方互动,保持与多国政策圈层的沟通渠道。

-

[sino-us] Being labeled ‘rival’ by Trump may not be a bad thing for China

President Donald Trump speaking at the State of the Union address at the US Capitol in Washington, DC, on January 30, 2018. Photo: ReutersUS President Donald Trump has referred to China as a rival and pledged to end an era of economic surrender in his first State of the Union address on Wednesday (Beijing time). But a Chinese expert has said calling China a “rival” may not be totally bad for China as it is undergoing deep economic reform.“Labeling China a ‘rival’ may not be a bad thing for China,” said Teng Jianqun, director of the Department of American Studies at the China Institute of International Studies and senior researcher of the Center for China and Globalization (CCG), a think tank based in Beijing.“As China is undergoing deep economic reform and transitioning toward a ‘new normal’, external motivation could be good for the country,” he said, adding though that it could also bring pressure to China.During his address, Trump singled out China and Russia as rivals of the US that challenged US interests, economy and values."Around the world, we face rogue regimes, terrorist groups and rivals like China and Russia that challenge our interests, our economy and our values," Trump said in his maiden State of the Union address.Calling China a "rival" was in line with the US national security strategy he unveiled in December, which reflected a harder line toward China, according to Teng, who said it also indicates the US government is undergoing “the biggest strategic transformation since the Cold War,” though the outcome remains uncertain.Relations between the world’s two largest economies are becoming tense as the US prepares to unveil the results of a probe into alleged Chinese intellectual property theft, which could result into a big "fine," Trump said.While Trump was expected to send strong warnings to countries about unfair trade practices, including stealing intellectual property and providing state aid to their industries, his comments on trade during the speech were restricted to three sentences in which he repeated that "fair and reciprocal" trade was necessary, without elaborating."We will work to fix bad trade deals and negotiate new ones," Trump said, adding "We will protect American workers and American intellectual property, through strong enforcement of our trade rules."The Trump administration has repeatedly accused China of trade abuses since the presidential campaign in 2016, and has threatened to take protectionist trade actions against Chinese exports to the US. But according to another Chinese expert, it could only be a “political card” that Trump plays in order to win over more supporters.“Talking about trade deficit can help gain American people’s attention, making them feel that it is Chinese who had stolen their jobs. It is politically tenable,” said He Ning, a senior researcher of the CCG. “Data on trade deficit only reflects the direction of trade, but does not indicate profit allocation between the two countries.”Trump announced last week that the US would slap tariffs of up to 30 percent on imports of Chinese solar panels, and is also considering broad tariffs or quotas on steel and aluminum following investigations by the US Department of Commerce into whether rising steel and aluminum imports represent a threat to national security.While this has led many to wonder whether a “trade war” would break out between the two countries, He said it’s necessary to be clear about what a “trade war” means in the first place.“If a ‘trade war’ is defined as measures like imposing anti-dumping duties or punitive tariffs, China and the US are in ‘trade war’ every year without exception,” he said, adding he doesn’t think “a ‘trade war’ that could bring huge adverse impact on both countries would happen,” thanks in part to multilateral trade agreements and rules.Meanwhile, “it is also necessary to be cautious about overreaction when dealing with the actions taken by the other side,” He warned.“In my conversations [with] the Chinese government, I feel there is going to be a restrained, yet reciprocal response to any action that the US takes. I don’t sense the Chinese government will escalate, necessarily. So as a result, hopefully that will allow a moderation [of] any kind of retaliation on both sides,” Jacob Parker, a vice president at the US-China Business Council in Beijing, told the sino-us.com on Wednesday.“Our companies hope that there will be no trade war between the US and China. A trade war is beneficial to no one. It will harm US companies and Chinese companies, and most of all, it will harm the US consumers, due the prices rise when tariffs are imposed,” Parker said.Chinese Foreign Ministry spokeswoman Hua Chunying says the US seems stuck in a Cold War mindset. Photo: APDespite the tense outlook of bilateral trade relations, a recent survey conducted by AmCham-China in partnership with Bain & Company showed that US companies are increasingly upbeat on China’s economy and US-China relations, with some 64 percent of the member companies reporting revenue growth in 2017, up from 58 percent in 2016 and 55 percent in 2015.‘Cold War mentality’In response to Trump’s labeling of China a “rival”, Hua Chunying, Chinese foreign ministry spokesperson, said on Wednesday that the US should abandon its Cold War mentality and outdated concept of zero-sum game, and view China and China-US relations in a correct way."We hope the United States will meet China halfway, respect each other, focus on cooperation, and control differences, to maintain a healthy and stable growth in bilateral ties," Hua told a routine press briefing in Beijing.The two countries have broad common interests and some differences as well, she said, adding their common interests far outweigh differences."History and facts prove that cooperation is the only correct choice for both sides. Mutual benefit leads to a better future," Hua said.Hua’s comments were echoed by Gao Feng, spokesperson of China’s Ministry of Commerce, who said in response to Trump’s address that the US should not “politicize” economic and trade issues between the two countries.Gao said on Thursday that China “tends to see the US as our partner in trade area”, adding that fair trade should be based on international rules instead of unilateral standards.China’s state-owned Xinhua News Agency also ran a commentary following Trump’s speech. Highlighting that “China will not block America’s pursuit of a ‘new moment’,” the commentary said “it is better for the United States to see China as a partner, rather than a rival, with a joint future rather than a divided one. China has contributed to the American dream, rather than destabilizing it.”From sino-us,2018-2-1

2018年2月5日 -

【经济日报】CCG报告:中国实现了世界经济史上的空前增长奇迹

2018年中国迎来了改革开放40周年,在过去这40年里,中国取得历史上少有的也被整个世界所公认的成就。处于新时代、新时期的中国,同时面临经济如何更好地实现“新转型”。2月2日,全球化智库(CCG)特邀高级研究员、联合国贸发会议经济事务高级官员梁国勇博士在CCG北京总部发布《全球变局与中国智慧:改革开放40年之际的回顾、展望和建言》报告。 报告指出,经过40年的高速发展,中国经济依托独特的市场体系和发展模式实现了世界经济史上空前的增长奇迹。改革开放以来的经济发展是由市场化、国际化、工业化和城市化四个转型协同推进的结果,而消费转型、服务转型、数字(智能)化和绿色化四方面的“新转型”将塑造中国经济的未来。在全球化进程由强变弱、“逆全球化”倾向、全球治理面临挑战的背景下,中国逐渐成为推动全球化的主要动力,使其更有活力、更加包容、更可持续的中坚力量。“一带一路”倡议则是中国推动全球经济治理体系改革的重大尝试,成为世界范围内推动国际经济合作和发展的重要议程。未来中国将面临改革开放深化、发展模式优化、经济转型升级的机遇和挑战。 梁国勇提出“增长平台”假说,建议将“降速增长、加速转型、避免危机、持续发展”作为中国经济顺利前行的长期战略选择。在“求稳”取代“求快”的政策基调基础上,实现从重视速度和数量到重视结构和质量的转变。应对中国经济的多重转型予以通盘考虑,进行全面、长期规划。 CCG特邀高级研究员、中国国际经济交流中心副总经济师徐洪才博士指出,未来中国经济以供给侧结构性改革为主线,同时打赢三大攻坚战,防范重大风险。未来几年,能够在稳健的货币政策背景下保持实体经济平稳运行,是个考验,保持GDP增长需要依靠消费转型和供给侧结构性改革,提高产能利用率、加强金融监管,新兴消费、消费结构升级是中国未来的发展引擎,但现在比重还不高。 而关于近期外汇市场的波动,人民币快速贬值,中国需要放缓节奏,把握人民币升贬的力度和节奏。文章选自经济日报,2018年2月3日

2018年2月5日 -

CRI | 中国智库7家入选全球智库百强,评选标准是什么今日揭秘

在线收听New analysis shows seven Chinese think tanks are now included among the world’s top-rated through 2017. Among them are China Institutes of Contemporary International Relations,Chinese Academy of Social Sciences and Center for China and Globalization etc.So what are the major parameters in the annual think tank report?For more on this, CRI’s Suyi joined in the studio by Mr. Wang Xin, vice president of the Center for China and Globalization;on the line we have Dr. Li Ling, associate professor at the Center for Think Tank Studies with the Shanghai Academy of Social Sciences;Dr. James McGann, director of the Think Tanks and Civil Societies Program (TTCSP) at the University of PennsylvaniaFROM CRI,2018-2-2

2018年2月5日 -

查道炯:谁怕特朗普?

专家简介查道炯,全球化智库(CCG)学术委员会专家,北京大学国际关系学院教授。最近特朗普变了。最近,这位72岁的美国总统在达沃斯论坛上留下一个和颜悦色、满面春风的形象。而特朗普执政美国这一年,打破传统党派界限在国会拉票,从驱逐非法移民、税改,到推出基建方案、国家战略报告,无不有证明其“言必行”的执政能力的一面。种执行力,体现在对外政策上,就成了“美国不能输”。本文原载于澎湃新闻2018-01-25,作者查道炯是北京大学国际关系学院、南南合作与发展学院教授。谁怕唐纳德·特朗普2018年初的中美关系风兼雨。如何管理?不必自乱阵脚。就美国政府对华政策的基础性框架而言,特朗普时期没有也不会发生变化。特朗普政府对华政策的基本面,仅仅是风格有所不同而已,基本延续了自第一任小布什以来的传统。简言之,有三方面:1)怀疑(克林顿时期实施的)“通过拉中国进入美国主导的国际经济体系,来诱导中国改变其国内经济与政治制度”这一逻辑是否成立。2)试探中国寻求强大的最终目的是不是将美国从东亚撵走。3)决心挫败中国实现国家完全统一的努力。非得说有什么变化的话,或许在于:特朗普政府尚未(公开地)挑战中国中央政府在香港、西藏、新疆的管治;(还)不那么热心声援中国的“民主人士”。特朗普个人关于中国的表述,就是美国(朝野、政商)建制派、不分党派的主流精英们的观点。换而言之,在对华政策的基础性逻辑方面,特朗普不是什么另类,而是一种“话糙理不糙”。精英们认可“谋求美国复兴”的战略目标,只是在是否以“美国优先”为外交口号上有不同看法。美国行政当局的执行力,也是建制派的普遍关注。紧接着奥巴马,特朗普是美国第二位没有经营州、市一级政府经验的行政部门最高首长。而联邦政府行政当局的执行力是国家发展和振兴所不可或缺的。特朗普执政这一年,打破传统党派界限在国会拉票,从驱逐非法移民、税改,到推出基建方案、国家战略报告,无不有证明其“言必行”的执政能力的一面。其间,当然也得到了从立法到司法系统,乃至宗教力量的配合。这种执行力,体现在对外政策上,就成了“美国不能输”。先看朝鲜问题。一个拥有核武的朝鲜,对美国(本土或海外利益)构不成现实威胁,因为美国反击的力量是毋庸置疑的。但朝鲜若用核武(胁迫)统一半岛,那么美国被驱赶离开是可能的前景之一。在这两个极端之间,朝鲜不间断地口头威胁美国,造成了后者威信(面子)上的压力。所以,美国对朝鲜:1)不谈、不打;2)利用朝核问题迫使中国在其它方面对美国做出让步;3)转身让美国百姓相信是中国不让美国赢得与朝鲜的斗争。美国因此而处于最有利的灵活外交位置。朝鲜问题不是“美国输了”的首要标志,甚至不是必要的标志。“中国赢了冷战结束以来的大国竞争”,才是“美国输了”这枚硬币的另一面。1985年通过迫使日本签订“广场协议”,美国成功管理了一个对其引领(primacy)地位的挑战。而今天的中国以及中美关系的战略基础,却不可能让美国有重复历史的选择。尽管从中方的视角感觉不可理喻,“不能让中国赢了”就等于“不能让美国输了”。处理美中双边贸易所伴生的政治挑战,美方既有咄咄逼人的一面,也难掩黔驴技穷的一面。跨入2018年,美方媒体不断放风,朝野不断派员来北京,要求重视特朗普当局即将推出的惩罚中国的贸易措施,饱含某种“都是为了中国好”、“为了两国关系稳定发展”的“谆谆劝告”。言外之意:特朗普是阻挡不住的,挑战其行事逻辑,也是不明智的。倘若中国主动提出“自愿出口限制”(voluntary export restraint, VER)清单, 则有利于美当局在其国内塑造“美国赢了”的政治舆论,至少阶段性如此。实际上,中国在2017年7月初汉堡G20期间就钢铁去产能所提出的方案,本质上就是某种VER。两周后的中美全面经济对话上,美方没能巩固这一成果。特朗普当局针对中国输美钢铁的“特别301”调查措施是在没有企业向政府提出反倾销请求,援引1992年美国国内立法为依据,而展开的。因为中国在2001年加入WTO,针对时下的被调查,是否可援引WTO相关规则来在多边机制下反制美国的做法,是一个贸易法律问题。现实情形是,美方执意要做,中方确实无法阻挡。其实,这不是第一次美方单边主义行为。例如,即便是在极力倡导多边合作的奥巴马政府期间,美方因抱怨IMF改革方案对中国有利而拒绝执行。国际间对此举的反应之一,便是支持中国牵头设立的亚洲基础设施投资银行。有理不在声高。应对特朗普政府在2018年“不得不对中国晓以利害”的架势,中方应坚持多边框架下达成的不歧视原则,冷静回应。这样做,才能收获“德有邻,必不孤”的效应。同时,中国有必要着重管理中美双边贸易相关的政治挑战(即:如何向国内外、两国之外的‘利益相关方’说明自己行为和选择的逻辑)。例如,美方常常挂在嘴边的“对等”(reciprocity),到底如何体现,是某产品在对方市场的占有率?投资的存量、增量?还是投资准入的审批条件?如此等等。就是很值得接过的话题。总之,以“让利”为手段的采购、投资项目,金额再大,其经济外交收效是有限的,中方有必要加强研究如何与美方在处理贸易争端的政治逻辑、道德制高点上对接。这种对接,也许说服不了美方改变做法,但应该有利于思辨自己的做法,有利于扩大、巩固自己的经贸朋友圈。文章选自政治学与国际关系论坛,2018年1月28日

2018年2月2日 -

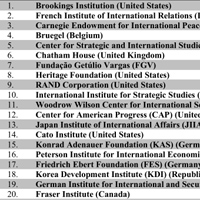

【China Daily】Seven Chinese think tanks among world’s best

A report released yesterday shows the number of Chinese think tanks has grown rapidly in the world over the past year.Seven Chinese think tanks were included among the world’s top think tanks in the 2017 Global Go To Think Tank Index Report, published by the think tank and civil societies program at the Lauder Institute of University of Pennsylvania.Selected from a list of over 175 top think tanks in the world, these seven think tanks are China Institutes of Contemporary International Relations; Chinese Academy of Social Sciences; China Institute of International Studies; Development Research Center of the State Council; Institute of International and Strategic Studies Peking University; Center for China and Globalization(CCG) and Shanghai Institute for International Studies.The report shows the United States at the top with the largest number of think tanks, at 1,872, while China holds second place with 512, followed by India with 444, and the UK with 311.“Think tanks are ’smart factories’ that can influence public policies, which I think is very important,” said Wang Huiyao, president of the Center for China and Globalization. “Think tanks are supposed to provide better ideas for the public and the making of public policy."According to the report, five Chinese thinks tanks have made their mark on Think Tanks to Watch. They are the Center for China and Globalization, Shanghai Advanced Institute of Finance, Chongyang Institute for Financial Studies, China Center for International Economic Exchanges and Our Hong Kong Foundation.Referred to as the "think tanks’ think tank", the think tank and civil societies program at the Lauder Institute manages and supports a global network of close to 7,000 think tanks and trains future think tank scholars and executives.The 2017 report shows continued expansion of think tanks in Asia, Latin America, Africa, the Middle East and North Africa in the past 12 years, while the number of new think tanks in the US and Europe has declined.From China Daily, 2018-1-31

2018年2月2日 -

【经济参考网】智库看特朗普国情咨文后中美政经走向

2018年1月31日,全球化智库(CCG)邀请专家,就特朗普首份国情咨文进行讨论。专家们认为,特朗普国情咨文更多是为一年来的政绩做宣传,“美国优先”的取向可能增加中美间的贸易摩擦,要谨慎处理中美经贸关系。 全球化智库(CCG)高级研究员、原中国驻美公使何宁表示,特朗普商人第一年主要解决国内政治,特别是2019年能否连任的问题,国情咨文也重在表功。但经济好转等和全球经济走势相吻合。相反在贸易问题上,并没有起色,所以着墨不多。 全球化智库(CCG)特邀高级研究员、中国国际问题研究院美国研究所所长滕建群表示,特朗普整个风格在回归建制派。他用美国第一、总统第一、中国第一、中产阶级第一和企业第一这六句话形象概括了特朗普的转变。他表示,特朗普处在一种收缩状态,他的政策,特别是对外政策是碎片化、反应式的。有两个基本的支撑点已经显现出来,一是孤立主义,美国在历史上一旦自己不景气时就把脑袋缩起来,不太愿意掺和地区事务;二是门户开放。这可能会增加中国的压力和中美之间关系的摩擦,包括贸易战。他访美期间感到,中美双方对中美关系的看法存在一些“温差”,但2018年两国不会出现大的问题。 全球化智库(CCG)特邀高级研究员、清华大学国家战略研究院研究员寿慧生认为,特朗普所谈的美国梦,和以前传统美国总统在这方面讲的还是略有差别。美国文化正在发生比较深刻的转移,从以前非常个人主义的文化理念正在推向一个个国家导向的观念,值得关注。 美中贸易委员会副会长JocobParker(彭捷宁)说,美国在中国的企业还是乐观的。美商会前两天刚刚公布了调查,对两国企业关系的改善持有乐观的态度,这个比例比去年有所提高。 全球化智库(CCG)特邀高级研究员、商务部国际贸易经济合作研究院原院长霍建国认为,中美贸易将是主战场,面临更加复杂化的变化。他认为,在美方强硬表态后,也会考虑到中国的态度,如果双方陷入相互制裁,是美国现阶段不愿意的。但是摩擦可能增加。从长远看,还是要特别谨慎地处理中美关系,包括中美中方贸易顺差,贸易平衡的问题。文章选自 经济参考网,2018年2月1日

2018年2月2日 -

【The New York Times】U.S. Tariffs, Aimed at China and South Korea

A solar panel project, at left, in Wuhan, China. The United States accuses China of swamping the market with cheap, subsidized solar panels. But those panels are increasingly made in other countries.CreditKevin Frayer/Getty ImagesDAVOS, Switzerland — When the Trump administration unveiled tariffs on imports of solar panels and washing machines — industries dominated by Chinese and South Korean businesses — they deliberately applied them to products from around the world.The move on Monday, in the eyes of United States trade officials, reflected the complexities of modern global trade. Though companies from just two countries account for the majority of both sectors, those firms have set up factories in multiple locations across national borders.As a result, the tariffs will affect factories and workers in a variety of countries, reflecting the globalized supply chains and byzantine corporate ownership structures that are at the heart of many ubiquitous products.The administration’s decision was followed on Tuesday by the announcement that a group of 11 countries would resurrect the Trans-Pacific Partnership, the pact that Mr. Trump pulled out of a year ago. The agreement, expected to be signed later this year, further complicates the president’s trade policies.The solar panel case in particular has been a case study in the complexity of global trade. Suniva, one of the American solar companies that had sought the tariffs, filed for bankruptcy protection last year, citing the effects of Chinese imports. But the majority owner of Suniva is itself Chinese, and the company’s American bankruptcy trustee supported the trade litigation over the objections of the Chinese owners.Here is a rundown of the wide-ranging impact the new tariffs may have.Will there be a backlash?Possibly — but not without costs for all the countries involved.China and South Korea could take their complaints to the World Trade Organization, which arbitrates international trade disputes.If the W.T.O. sided with those countries, the United States would be under considerable pressure to back down. If it did not, there would be two major sets of consequences. For one, the World Trade Organization could greenlight other countries’ setting similar trade limits. More broadly, it would raise the question of whether the United States accepts the organization’s decisions — Robert E. Lighthizer, the United States trade representative, has argued for years that such decisions should, essentially, be advisory.The United States market has long been very attractive to foreign companies, and not just for its large and affluent set of consumers. Its tariffs on imports are much lower than those of most other countries, and it also has relatively low sales taxes. But President Trump has regularly questioned whether existing free trade agreements are in the best interests of the country, making it possible that such favorable terms may erode.Still, China and South Korea have leverage of their own. They are big importers of American-made machinery and agricultural products, and China, in particular, has long been a big buyer of soybeans and other crops from states that supported Mr. Trump in the 2016 election.Indeed, as an enormous consumer of all types of global goods, China could also easily punish American companies by opting to buy from international competitors. For instance, it could opt for Airbus planes over Boeing’s or crack down on General Motors while leaving Volkswagen alone.A trade fight would, however, be painful. Both China and South Korea export a lot more to the United States than they import, meaning higher tariffs could hit their economies harder.Who else could be affected?The United States accuses China of swamping the market with artificially cheap, subsidized solar panels. But increasingly, those panels come from elsewhere. Steep tariffs imposed in 2012 on solar panels imported from China have made it cheaper for Chinese companies to assemble the panels in factories elsewhere before shipping them to the United States.Countries like Malaysia and South Korea now account for most of the United States’ solar imports, according to data from Global Trade Atlas, a database maintained by the research firm IHS Markit.Chinese companies like JA Solar and JinkoSolar, for example, have opened factories in Malaysia, though most such businesses still do much of their research and development at home.The broad manufacturing base means other countries may face job losses and other hardships in the face of the United States tariffs, which could galvanize opposition to the president’s action.American companies also manufacture some of their panels in Southeast Asia before importing some of them back into the United States. But their products tend to use a different technology, known as thin-film solar panels, which are not covered by the latest tariffs.What happens next?President Trump is set to speak to world leaders gathered this week at the World Economic Forum in Davos, Switzerland, where he could drop hints of whether the United States has more trade barriers to announce.Washington could take action on aluminum or steel imports, two categories that have vexed previous presidential administrations. It is also exploring a major trade action against China focused on intellectual property.“China’s regulatory authorities do not allow U.S. companies to make their own decisions about technology transfer and the assignment or licensing of intellectual property rights,” Mr. Lighthizer’s office said as part of a broader report last week, suggesting possible strong action.The Trump administration’s move nevertheless leaves room for negotiation.The tariffs announced on Monday on solar panels were not as high as American companies had requested. And with washing machines, the tariffs were somewhat higher than requested, but the administration said the higher rate would not kick in until the United States imports 1.2 million washers. A lower charge will apply to any imports below that threshold.He Weiwen, a senior researcher of the Center for China and Globalization(CCG) in Beijing and a former Chinese Commerce Ministry official who is now an influential trade policy researcher in Beijing, said Chinese policymakers had reacted with “strong dissatisfaction” to the tariffs. But he predicted that China’s response would at first be cautious, as officials wait to see how strong the other American actions will be.“We cannot expand to an overall trade war,” he added.From The New York Times, 2018-1-23

2018年2月1日